What a nice surprise. I feel like I hit the jackpot literally. My company is Jumbo Interactive and they have made their mark in the niche market of lotteries and internet software. I am definitely a supporter of trying to win the lotto and was hoping for some inside information on the key to winning the big jackpot. I can also say that of the forty-three million dollars in profit Jumbo Interactive made during 2020, I contributed at least one or two ticket sales per week.

The company was started in 1995 as Squirrel Software Technologies PTY LTD. Their initial sales pitch was building software for the web and selling website design. This business idea then evolved into a new software company which eventually was named Jumbomail. The year 2000 saw the company expand massively as this was the period of the dot.com bubble. Internet was going crazy and when Jumbomail was listed on the stock exchange the share prices skyrocketed. Their current share price is sitting at an impressive $12.91. 2005 was an important year for Jumbomail where they acquired TMS Global Services PTY LTD and agreements to sell OZ Lotto and Powerball tickets. This then led to a name change to Jumbo Interactive Limited. Jumbo Interactive went from strength to strength securing another ten-year deal with tatts until the year 2030. Imagine that certainty and longevity within a business.

A strong strategy plan from investing in further companies and utilizing web-based services has certainly led Jumbo Interactive Limited on a profitable pathway or should I say runway. Further extension into charity lotto has also extended the market offerings for this company and its shareholders. The simplicity of purchasing lotto tickets would be a certain growth strategy for this company. Using the healthy internet sales channel people can access a lotto ticket through an app on their phone in the space of under a minute. They made the technology easy for younger tech-savvy players to the older demographic. This strategy resulted in an $80 million dollar Powerball win for a 72-year-old customer which in turn increased the customer base with an influx of the older demographic.

Despite 2020 being a hard year for most companies due to the Covid-19 pandemic, the Australian online lottery powered forward. Many overseas lotteries that didn’t have an on-line system suffered badly which gave Jumbo Interactive an avenue to seek to increase their customer base by offering online lotteries software. Jumbo saw this opportunity to introduce a play from home innovative while people were in lockdown. During the 2020-year Jumbo Interactive saw an 8.7% increase in ticket sales and a 9.1% increase to revenue. Jumbo has a FY22 vision of increasing its sales to $1 Billion in tickets. Below shows the ticket sales hours before the big $80 million dollar jackpot and also the amount of ticket sales the two days before the jackpot.

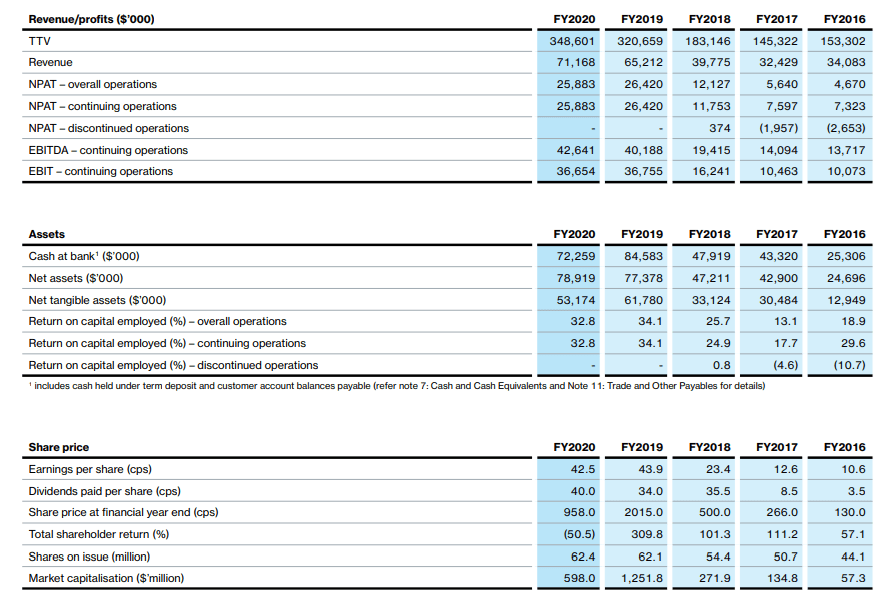

This also tells a very healthy business reality. In the space of four years Jumbo Interactive has doubled its revenue, tripled its earnings before income tax and, tripled its net assets. The share price however tells a different story and is critical to understanding the performance of this company. The shareholder return is pretty erratic and goes from a shareholder return of 309 to a negative 50. To me that doesn’t make sense with such growth in the revenue figures. Hopefully with the financial statement analysis I can figure out why.

I’m very excited to be analyzing this company and who knows maybe I will find some insider knowledge to winning the big jackpot. But I will need to be careful when digging in deep, my IT department at work doesn’t let me google this website. I don’t want them to think I have a gambling habit.