5 Year look ahead for Jumbo Interactive Ltd completed with Steps 1-5

I would love some feedback on my assignment. Thank you for looking through my valuation of Jumbo Interactive Ltd.

5 Year look ahead for Jumbo Interactive Ltd completed with Steps 1-5

I would love some feedback on my assignment. Thank you for looking through my valuation of Jumbo Interactive Ltd.

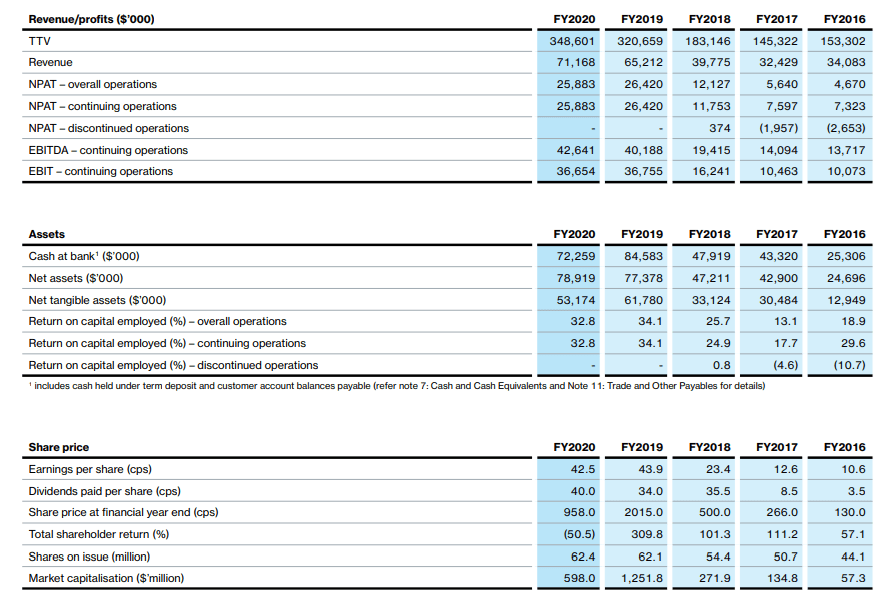

2019 was a breakout year for Jumbo as quoted in their 2019 annual report. There was a 64% growth increase for this year due to a strong run of jackpots including two $100 million Powerball jackpots and a new SaaS (Software as a Service) business division was launched called “Powered by Jumbo”. This new division has few geographic boundaries, and addresses the need for a proven and robust software system for lottery operators with which to drive future growth. Jumbo’s vision is to lead a Jumbo’s new “$1 Billion Vision” – $1 Billion in ticket sales on the Jumbo platform by FY22. The growth for 2020 wasn’t so significant with a 9 per cent increase. I don’t think I will forecast another big growth as that was seen in 2019 but I think there will be a steady run into the future especially with a ten-year deal signed and market expansion into charitable lotto’s.

2019 saw a 106% increase in new accounts to 444,004 and also a 74% increase in active customers to 761,863. Essentially the new SaaS business, branded “Powered by Jumbo”, provides software to other lottery operators wishing to emulate the success of OzLotteries.com. The first two customers for “Powered by Jumbo” are Mater Lotteries (signed November 2018) and the Endeavour Foundation (signed August 2019). The agreements provide a full software platform capable of operating both online and offline ticket sales for a period of 5 years. These strong revenue streams showed a profit margin over the last four years ranging from 17% to 35%. There were a few factors that contributed to this, the merger of Tatts and Tabcorp in 2017, Jumbo Lottery Software Platform that went live during 2017 with advancements in software technology and new innovations such as Advanced Data Analytics, Artificial Intelligence and Machine Learning are making subtle but effective improvements to the App.

Let’s now look to see how the net operating assets stack up to the above success stories in growth and profit margins. I would also expect to see a positive return on Jumbo Interactive LTD net operating assets however this positive result wasn’t seen until 2020. There seemed to be a delay in high growth sales to an acceptable return on these assets. Jumbo Interactive net operating assets went from negative ninety-six thousand in 2017, a negative six million in 2019 to a positive seven million in 2020. This was due to the acquisition of Gatherwell Limited in the UK, the largest external lotteries manager in 2019 and the realization of intangible assets in 2020. It’s quite deceiving with all these positive enhancements to the company that the net operating assets could actually be in a negative state. By having these negative net operating assets really did mess with my happy positive trail. The net operating assets influences many ratio comparisons, two being the asset turnover ratio and the return of net operating assets. The asset turnover compares the sales / net operating assets to see the return generated on these assets. I really didn’t understand this ratio until the NOA became a positive figure.

The ratio seems to be going in the right direction and the high revenue sales for 2019 has offset the increased negative net operating assets with an improvement of results from the previous two years. Without this growth in sales, we would be seeing a different story with regards to asset turnover. The RNOA looks at the return from the operating income (OI) divided by the net operating assets. With the operating income being a smaller number, I was expecting to see a dramatic negative figure. The return showed the same pattern as the ATO with a positive return showing in 2020.

Despite the improving trend in the sales, returns and asset turnover I’m not expecting to see a positive economic profit. I originally had an economic profit showing in the first three years however with a negative RNOA I didn’t think this was correct. So, I added a negative sign to the formula. I am hoping that is correct. It wouldn’t make sense to me that Jumbo Interactive Ltd would have a positive economic profit with negative RNOA.

It’s really deceiving when you read through the annual reports with such positive growth and then see the above ratios. It’s telling me a different reality to all the buzz that’s in the annual reports. I find it quite difficult to comprehend the negative operating assets when Jumbo Interactive have an equity balance that has doubled in the last four years from forty-two million to seventy-eight million and none of it is funded by debt. The bulk of Jumbo Interactive Ltd operating assets are intangible assets which have also doubled in the last four years. I find it quite strange for a company that creates such growth through assets that aren’t physical and you can’t touch or see the physical shape of them. I think my forecast over the next five years will be modest with a little growth each year stemming from the economic and business drivers. These are to be discussed in my next post. Stay tuned….

I took for granted that my previous studies would enable me to cruise through this activity. Turns out I was wrong. It actually took more time to familiarize myself with the various types of revenue, expenses, assets and liabilities and where they sit in the operating and financial activities of the company then it did to re-state the figures. There are certain elements that took me longer to figure out those including the tax benefit and how this has been applied in the comprehensive income statement and whether indeed it is correct.

The separating of the revenue into operating and financial also took me awhile to hunt through the notes and break down the components. In my comprehensive income statement, there was a random profit and loss from discontinued operations that wasn’t either a revenue or expense, I have applied this after the total operating expense. Fingers crossed this is also correct. The biggest confusion for me was the tax benefit that was applied in the net finance expense area that actually turned out not an expense. Some revision on this topic was certainly needed. I would certainly love some feedback for this area. It balanced in the end so let’s hope I have my theory correct.

The re-instating of the balance sheet was a little too easy for me and I was quite surprised that Jumbo Interactive had no financing debt. Could that be correct? Could a company operate all with no finance debt? It seems Jumbo Interactive does. It made sense the majority of Jumbo Interactive’s operating assets were intangible assets. Their whole company is based around supply software, online demand and internet sales. I haven’t started to ratio analysis but I am super curious what these ratios will tell. Honestly this company looks too good to be true. Certainly, good strategic planning and future planning has led to these outstanding results. From what I can see they have double and tripled their revenue and profits in the last four years. What a great few years for them. I think having a lockdown and people being confined to their houses gave Jumbo Interactive a niche in the market.

I wasn’t sure how much information to add into this so I have included everything except step 8 which I am yet to finish. I would really love some feedback on the application of the tax benefit and whether I have formulated it correctly. Also some feedback on the re-instating of the comprehensive income statement.

Happy reading

What a nice surprise. I feel like I hit the jackpot literally. My company is Jumbo Interactive and they have made their mark in the niche market of lotteries and internet software. I am definitely a supporter of trying to win the lotto and was hoping for some inside information on the key to winning the big jackpot. I can also say that of the forty-three million dollars in profit Jumbo Interactive made during 2020, I contributed at least one or two ticket sales per week.

The company was started in 1995 as Squirrel Software Technologies PTY LTD. Their initial sales pitch was building software for the web and selling website design. This business idea then evolved into a new software company which eventually was named Jumbomail. The year 2000 saw the company expand massively as this was the period of the dot.com bubble. Internet was going crazy and when Jumbomail was listed on the stock exchange the share prices skyrocketed. Their current share price is sitting at an impressive $12.91. 2005 was an important year for Jumbomail where they acquired TMS Global Services PTY LTD and agreements to sell OZ Lotto and Powerball tickets. This then led to a name change to Jumbo Interactive Limited. Jumbo Interactive went from strength to strength securing another ten-year deal with tatts until the year 2030. Imagine that certainty and longevity within a business.

A strong strategy plan from investing in further companies and utilizing web-based services has certainly led Jumbo Interactive Limited on a profitable pathway or should I say runway. Further extension into charity lotto has also extended the market offerings for this company and its shareholders. The simplicity of purchasing lotto tickets would be a certain growth strategy for this company. Using the healthy internet sales channel people can access a lotto ticket through an app on their phone in the space of under a minute. They made the technology easy for younger tech-savvy players to the older demographic. This strategy resulted in an $80 million dollar Powerball win for a 72-year-old customer which in turn increased the customer base with an influx of the older demographic.

Despite 2020 being a hard year for most companies due to the Covid-19 pandemic, the Australian online lottery powered forward. Many overseas lotteries that didn’t have an on-line system suffered badly which gave Jumbo Interactive an avenue to seek to increase their customer base by offering online lotteries software. Jumbo saw this opportunity to introduce a play from home innovative while people were in lockdown. During the 2020-year Jumbo Interactive saw an 8.7% increase in ticket sales and a 9.1% increase to revenue. Jumbo has a FY22 vision of increasing its sales to $1 Billion in tickets. Below shows the ticket sales hours before the big $80 million dollar jackpot and also the amount of ticket sales the two days before the jackpot.

This also tells a very healthy business reality. In the space of four years Jumbo Interactive has doubled its revenue, tripled its earnings before income tax and, tripled its net assets. The share price however tells a different story and is critical to understanding the performance of this company. The shareholder return is pretty erratic and goes from a shareholder return of 309 to a negative 50. To me that doesn’t make sense with such growth in the revenue figures. Hopefully with the financial statement analysis I can figure out why.

I’m very excited to be analyzing this company and who knows maybe I will find some insider knowledge to winning the big jackpot. But I will need to be careful when digging in deep, my IT department at work doesn’t let me google this website. I don’t want them to think I have a gambling habit.

Hi Everyone

Please see below my tutorial question Part B. Any feedback would be greatly appreciated.

Happy Studies

Leigh

Hi Guys,

I have updated my tutorial question as thanks to the fantastic feedback I had an error in the original file. Please have a look at let me know if I have fixed my error.

Thanks

Leigh

Tutorial Question

Hi

Please see attached tutorial question. It is quite basic but happy for some feedback.

Thanks

Leigh

Good evening fellow accounting students. I have finished a rough draft of the assignment 1 steps 7-10. I would love some feedback as we are packing up and getting ready to go on a four week adventure to the outback (while I still study)

I have posted below my steps 3-5 reflections. I would love some feedback. Especially around the Step 4 and the use of assets in this example.